Issue: Luna County Road Access Taxes

Through our membership, the LCROA has recently been made aware of tax practices in Luna County which appear to be at odds with several County Resolutions, the existing Land Use/Population Density and the Luna County Comprehensive Plan.

Luna County Resolutions

For over 40 years, ranchette and subdivision property owners have been the only land owners compelled to pay a road access tax. In 1973 and in 1975, the Luna County Commission adopted resolutions that required all Ranchette property owners to pay road access taxes1 due to concerns that if all of the Ranchette parcels were to be developed, Luna County would have to take on the burden of the additional road maintenance cost. Initially, this tax rate was set at $0.01/foot of road frontage, calculated to be approximately half the cost of maintaining the roads. This rate was applied to roads in the Ranchettes, regardless of whether they were paved, gravel, improved dirt or unimproved, and often neglected, dirt.

Existing Land Use/Population Density and the Current Tax Burden

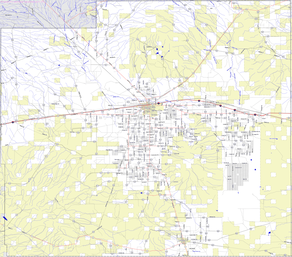

Currently, the majority of the Ranchette roads are unimproved dirt. Of the 254 miles of streets located within the Sunshine Valley Ranchettes subdivision, only 1.5 miles of the roads are asphalt. Approximately 11 miles are gravel road and roughly 5 miles are improved dirt lanes i. e. have bar pits at least on one side of the roadway. That leaves 236 miles of unimproved dirt trails that are graded every 3-6 years or less.

Today, any Ranchette owner with property that abuts a street right-of-way is required to pay $0.08/foot of road frontage. If our calculations are correct, this means Luna County is now collecting $422 of road access taxes for every mile of road right-of-way per year from Ranchette owners.

In other words, Luna County is collecting $214,000. This figure includes $107,000 in road access taxes plus matching State funds annually, for maintaining around 18 miles of actual roads just in the Sunshine Valley Ranchette subdivison. All other property owners in Luna County, located outside of the Ranchettes, pay NO road access taxes—and today, Some of these areas are more developed and densely populated than ranchette subdivisions. As a matter of fact, within the 21 square-mile-development of Sunshine Valley, New Mexico state records show just 31 wells and a 2013 Land Survey shows a mere 6 residents being occupied. This can scarcely be called a "highly populated area".

Luna County Comprehensive Plan

The County Comprehensive Plan refers to the Ranchettes and their half-acre lots as "antiquated subdivisions. " The Comprehensive Plan also does an outstanding job of describing the issues for development within these subdivisions. There are approximately 80,000 lots platted in these areas. The Plan states that these subdivisions have little-to-no infrastructure other than dirt roads, graded through the desert, that rarely meet the minimum standard for County road construction.

Clearly, Luna County needs a more equitable way of collecting taxes for road maintenance, All land owners, both within and outside of the Ranchette subdivisions who have land abutting country road rights-of-way, should share in the financial responsibility of maintenance.

Hopefully, the ethical vote of the County Commissioners to adopt the Luna County Comprehensive Plan in December 2012 was just the first step in correcting this unjust situation and in making our road tax system impartial to all by:

Prepared in 2016 by: Carol Felsing, Vice President, LCROA [email protected] - 575 -200-4172

1 Ranchettes for this paper are all those listed in the 1973 and 1975 County Resolutions under footnote 2 including Deming Ranchettes units

1-127, Sunshine Valley Ranchettes, Arrowhead Park, Butterfield Trail Estates, Hillside Estates, Holdridge Estates, LaPaz Estates, Mountain View Estates, Pershing Heights, Siesta Estates, and Sun-Aire #1 & 2 subdivisions

Through our membership, the LCROA has recently been made aware of tax practices in Luna County which appear to be at odds with several County Resolutions, the existing Land Use/Population Density and the Luna County Comprehensive Plan.

Luna County Resolutions

For over 40 years, ranchette and subdivision property owners have been the only land owners compelled to pay a road access tax. In 1973 and in 1975, the Luna County Commission adopted resolutions that required all Ranchette property owners to pay road access taxes1 due to concerns that if all of the Ranchette parcels were to be developed, Luna County would have to take on the burden of the additional road maintenance cost. Initially, this tax rate was set at $0.01/foot of road frontage, calculated to be approximately half the cost of maintaining the roads. This rate was applied to roads in the Ranchettes, regardless of whether they were paved, gravel, improved dirt or unimproved, and often neglected, dirt.

Existing Land Use/Population Density and the Current Tax Burden

Currently, the majority of the Ranchette roads are unimproved dirt. Of the 254 miles of streets located within the Sunshine Valley Ranchettes subdivision, only 1.5 miles of the roads are asphalt. Approximately 11 miles are gravel road and roughly 5 miles are improved dirt lanes i. e. have bar pits at least on one side of the roadway. That leaves 236 miles of unimproved dirt trails that are graded every 3-6 years or less.

Today, any Ranchette owner with property that abuts a street right-of-way is required to pay $0.08/foot of road frontage. If our calculations are correct, this means Luna County is now collecting $422 of road access taxes for every mile of road right-of-way per year from Ranchette owners.

In other words, Luna County is collecting $214,000. This figure includes $107,000 in road access taxes plus matching State funds annually, for maintaining around 18 miles of actual roads just in the Sunshine Valley Ranchette subdivison. All other property owners in Luna County, located outside of the Ranchettes, pay NO road access taxes—and today, Some of these areas are more developed and densely populated than ranchette subdivisions. As a matter of fact, within the 21 square-mile-development of Sunshine Valley, New Mexico state records show just 31 wells and a 2013 Land Survey shows a mere 6 residents being occupied. This can scarcely be called a "highly populated area".

Luna County Comprehensive Plan

The County Comprehensive Plan refers to the Ranchettes and their half-acre lots as "antiquated subdivisions. " The Comprehensive Plan also does an outstanding job of describing the issues for development within these subdivisions. There are approximately 80,000 lots platted in these areas. The Plan states that these subdivisions have little-to-no infrastructure other than dirt roads, graded through the desert, that rarely meet the minimum standard for County road construction.

Clearly, Luna County needs a more equitable way of collecting taxes for road maintenance, All land owners, both within and outside of the Ranchette subdivisions who have land abutting country road rights-of-way, should share in the financial responsibility of maintenance.

Hopefully, the ethical vote of the County Commissioners to adopt the Luna County Comprehensive Plan in December 2012 was just the first step in correcting this unjust situation and in making our road tax system impartial to all by:

- Assessing road access taxes on ALL Luna County properties—not just Ranchette subdivision lots, abutting county road rights-of-way.

- Restricting road access tax rates by basing them on the actual costs of maintenance—whether they be paved, graveled, improved or unimproved dirt roads.

Prepared in 2016 by: Carol Felsing, Vice President, LCROA [email protected] - 575 -200-4172

1 Ranchettes for this paper are all those listed in the 1973 and 1975 County Resolutions under footnote 2 including Deming Ranchettes units

1-127, Sunshine Valley Ranchettes, Arrowhead Park, Butterfield Trail Estates, Hillside Estates, Holdridge Estates, LaPaz Estates, Mountain View Estates, Pershing Heights, Siesta Estates, and Sun-Aire #1 & 2 subdivisions